Over the past few weeks, something atypical occurred within parts of the markets that are normally oases of calm. During troubled times, the U.S. dollar, U.S. government bonds, and gold are typically seen as benefactors of a flight-to-quality trade. However, only gold is performing as one would typically anticipate. This led some pundits to raise the question whether the U.S. dollar may be losing its “reserve currency” status.

To take a step back, a reserve currency is a foreign currency that is held in significant quantities by global central banks as part of their foreign exchange reserves. These reserves are used in international transactions to facilitate trade, among other uses. According to a 2024 paper by the Brookings Institute, as of 2022 the U.S. dollar was used in 54% of foreign trade invoices. What this means in practice is that foreign firms and governments are conducting trade in and exchange U.S. dollars even when U.S. companies are not involved in the transaction.

Why is this the case? Well, U.S. capital markets are deep, open, transparent, and highly liquid – aspects that make the U.S. dollar easily convertible around the world and important to attain the reserve currency status. Additionally, the Federal Reserve extends swap lines to foreign central banks providing them with dollar liquidity during times of severe market stress. Think of this as a proverbial plumber on call to make sure the pipes of the global financial system work appropriately. It is a bit more complex than that, but that is beyond the scope of this commentary.

How does the United States benefit for having the U.S. dollar as the world’s reserve currency? There are many, but one significant benefit is this privilege lowers the cost of borrowing and, therefore, debt service for the U.S. government. As foreign central banks seek to own U.S. dollars, they often buy U.S. Treasury bonds denominated in U.S. dollars. This provides a natural buyer of U.S. debt for reasons beyond just the return potential or quality. Additionally, a dominant dollar and exchange rate reduces the cost of imports making it easier for U.S. consumers to purchase cheap goods from abroad. There are also other important benefits, such as a country with the reserve currency status is less likely to face a currency crisis or sudden devaluation of the currency.

What are challenges to U.S. dollar dominance? The weaponization of the dollar through sanctions or other behaviors without support of our allies is unlikely to be a positive catalyst. American politics are contentious and polarized, fiscal policy is undisciplined (as seen in the rising debt-to-GDP data), and any question as to whether the full faith and credit of the U.S. government backs our debt is not additive to retaining our position as the central reserve currency of the world. In recent memory, shutting down the government or having two rating agencies downgrade the quality of the U.S. long-term credit ratings are items that are not supportive.

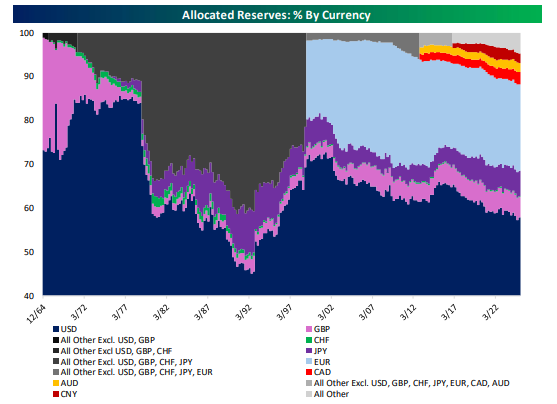

Where are we today? Despite the headlines, we believe the U.S. dollar is on sound footing, at least for the foreseeable future. The best data we have is the IMF’s quarterly COFER survey, although this data does not include gold. Gold reserves have been rising, but, in our view, mostly as a function of price than volume. The IMF COFER survey provides us a snapshot of 149 different reporting entities and includes denomination currency of reserves for 92.8% of all reserves, according to our friends at BeSpoke Investment Group. Of the total allocated reserves, 58% are held in U.S. dollars. That is down about 7% from the turn of the century and off from a peak of more than 85% during the 1970’s. It is worth noting, the dollar has actually increased from its low share of 45% in 1992, so the move has not been linear. While the U.S dollar has lost market share since the 1970’s, its share of reserves is still more than twice as large as the next highest share – the Euro. And, the Euro is also down from a peak of 28% in 2009 to 20% today.

In other words, what we have seen is not a shift to another reserve currency, but a diversification of reserves into a broader pool of liquid foreign exchange where safe assets are issued – in general, a good thing.

In our opinion, for the foreseeable future, the U.S. dollar losing its status as the reserve currency is one item that should not keep people awake at night; however, we should be vigilant. At this point, there is no realistic alternative to the U.S. dollar. We are privileged to be the world’s reserve currency and history informs us that reserve currencies have come and gone with the evolution of the world’s political order. To continue to maintain the benefits, America must act responsibly and fulfill its special duty for the smooth management of the international monetary system.

5405 Wisconsin Ave., Suite 330, Chevy Chase, MD 20815

(301) 799-9001

General Disclosure

This Presentation is for informational purposes only and does not constitute an offer to sell or the solicitation of an offer to purchase any security or investment product or services. The content of this Presentation is provided solely for your personal use and shall not be deemed to provide access to any particular transaction or investment opportunity.

TritonPoint Wealth (TPW) does not intend the information in this Presentation to be investment advice, and the information presented in this Presentation should not be relied upon to make an investment decision. Any third-party information contained herein was prepared by sources deemed to be reliable but is not guaranteed.

TPW is a registered investment adviser with the Securities and Exchange Commission providing investment advisory and financial planning services. Any reference to the terms “registered investment adviser” or “registered” does not imply that TPW or any person associated with TritonPoint Wealth has achieved a certain level of skill or training. A copy of TPW’s current written disclosure (ADV 2A Firm Brochure) discussing our advisory services and fees is available for your review upon request. TPW, in addition to providing investment advisory and financial planning services, provides business consulting services. In connection with its business consulting services, TPW does not provide tax or legal advice.

This material is proprietary and may not be reproduced, transferred, modified, or distributed in any form without prior written permission from TPW. TPW reserves the right, at any time and without notice, to amend, or cease publication of the information contained herein. Certain of the information contained herein has been obtained from third-party sources and has not been independently verified. It is made available on an “as is” basis without warranty. Any recommendations, projections, market outlooks, or estimates are based upon certain assumptions and should not be construed as indicative of actual events that will occur.