Investing is not just about the returns you see on the screen. How much of those returns you get to keep after taxes is also of tremendous importance. Of course, determining the optimal asset allocation for one’s unique goals and objectives is paramount, but here we highlight the keys to achieving tax-efficiency in portfolio management. Just as it sounds, tax-smart investing is a strategy that considers the tax implications of investment decisions in an effort to maximize after-tax returns. A critical component of this is asset location, which involves placing investments in the most tax-efficient accounts available. Let’s dive a bit deeper into the various investment planning techniques that can help you potentially achieve superior after-tax results.

Tax-Loss Harvesting: The Classic Approach

Tax-loss harvesting is a trading strategy that involves intentionally selling securities at a loss. This strategy may be used throughout the year to mitigate taxes owed on realized capital gains and improve overall investment efficiency (i.e., maintain proper position sizing and target asset allocation). It’s a proactive approach meant to turn investment lemons into lemonade by using market downturns to create tax advantages to the investor. When executing this strategy, it is extremely important to note that there is a tax law that needs to be followed – it’s called the “wash sale rule” and it applies to equities, contracts, options, and all other types of securities and trading. If you sell a security at a loss and buy the same or a substantially identical security within 30 calendar days before or after the sale, you won’t be able to take a loss for that security on your current-year tax return. For this reason, it is critical that wash sales are avoided at all costs.

Direct Indexing: Gaining Popularity & Executing in All Market Conditions

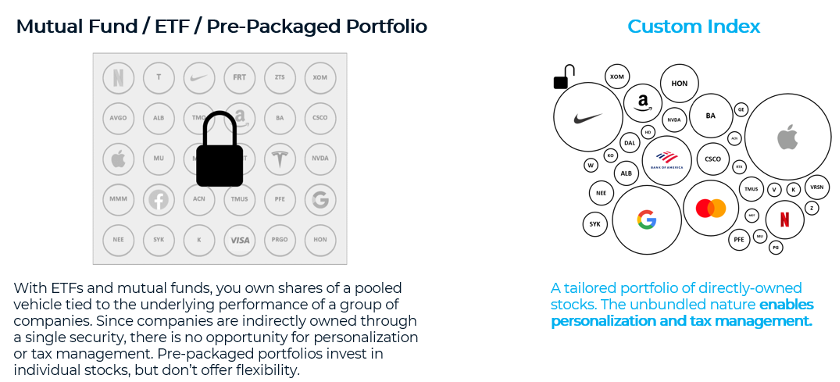

Direct indexing is a form of tax management where investors own most of the underlying shares of an index, allowing for a greater level of control over the individual tax outcomes of their investments. By directly indexing, investors may tailor their portfolios to harvest tax losses or to align with personal values, such as excluding certain stocks, industries, or sectors. This is something traditional funds and ETFs do not offer.

Source: O’Shaughnessy Asset Management, L.L.C. (“OSAM”)

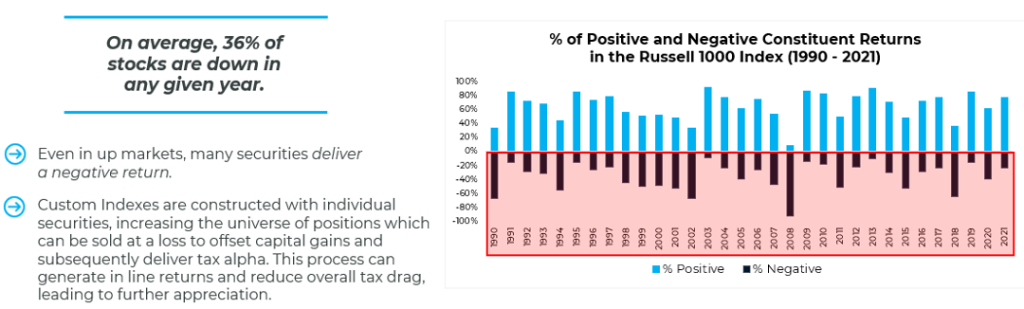

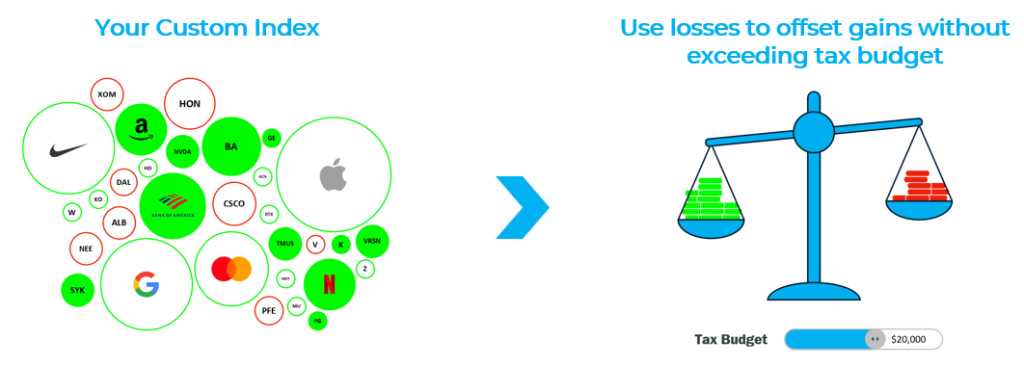

The implementation of a direct indexing strategy may be a terrific compliment to a portfolio that already holds concentrated or highly appreciated positions. Throughout the course of the year, whether in up or down markets, direct indexing aims to capture capital losses to help you offset capital gains realized elsewhere. For example, a direct indexing strategy that strives to track the S&P will identify dislocations to sell individual stocks at a loss and immediately replace them with a close peer. Here’s a classic example during a market sell-off – one might own Coca-Cola in the direct indexing strategy, and it is sold for a loss and immediately replaced with Pepsi. This process allows the investor to maintain exposure within the same asset class and economic sector while realizing a capital loss at the same time. These strategies are particularly effective when market downturns occur as it allows for a greater amount of portfolio turnover.

Source: O’Shaughnessy Asset Management, L.L.C. (“OSAM”)

If you have more realized capital losses than gains in a given year, you now have a tax asset called “carry-forward losses” to use in future years as a part of your investment strategy. This tax asset lends to additional flexibility when trying to lock in capital gains as you can offset a portion or all with the losses from years past.

Source: O’Shaughnessy Asset Management, L.L.C. (“OSAM”)

Tax Deferral & Charitable Giving: Thinking Beyond Traditional Tactics

We would be remiss if we did not at least introduce two tactical concepts related to tax-smart investing that can have a significant impact on one’s financial position when used in the appropriate situation. The following is intended to be a primer as each warrants a lengthier discussion with your advisor and CPA.

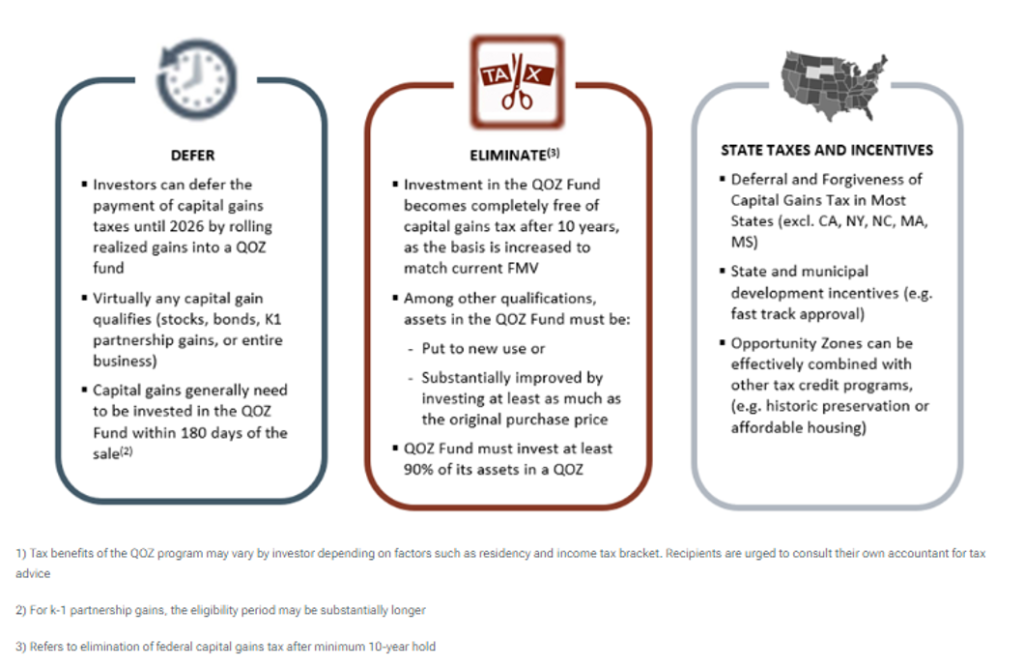

Created under the Tax Cuts and Jobs Act of 2017, the concept of Qualified Opportunity Zones (QOZs) was born and quickly gained popularity. The purpose of the bipartisan legislation was to help spur economic growth and create opportunities for employment by incentivizing investments in distressed communities. Importantly, the legislation offers many tax advantages for QOZ investors. For example, (1) if you realize a substantial capital gain from selling highly appreciated stock and you invest in a QOZ within 180 days from the sale of the stock, then you may defer the capital gain tax payment on the stock until December 31, 2026 or when the QOZ investment is sold, whichever comes first, (2) If a QOZ investment is held for at least 10 years, then the investor will not owe any capital gains tax on that investment when it is sold. Furthermore, the QOZ investment may also benefit from a step-up in basis upon death, if left to an eligible beneficiary. As always, please consult with a tax professional for specific tax advice.

Source: GTIS Partners (“GTIS”)

Charitable giving strategies can also help optimize your tax situation, especially in a year of high income or realized capital gains. One of the most widely used vehicles is called a Donor Advised Fund (DAF). For those that are charitably inclined, one may contribute cash or stocks to the fund (highly appreciated stocks are often the best choice here) in exchange for an immediate tax deduction. Once the contribution has been made, it cannot be undone because contributions to a DAF are considered irrevocable gifts. The DAF then provides the owner with the ability to invest and grow their donation tax-free, grant to as many qualified charities as they would like, and provide a legacy for their family and loved ones, as successor trustees may be named to such accounts. As always, please consult with a tax professional for specific tax advice.

Account Registration Types: Asset Location is Critical

Different types of accounts have different tax characteristics, such as tax-deferred retirement accounts (i.e., 401(k)s and IRAs), taxable accounts, and tax-exempt accounts like Roth IRAs. Asset location is the strategic practice of placing assets that will be heavily taxed in more favorable tax environments. For example, holding corporate bonds in a tax-deferred account helps one avoid ordinary income tax that would otherwise be owed if those bonds were held in a taxable account. Whereas, holding municipal bonds in a taxable account helps one maximize the benefit of earning tax-free interest income – a primary benefit of owning municipal bonds. Further, by placing high-growth stocks in a Roth IRA where earnings can be withdrawn tax-free promotes maximum growth potential.

Conclusion

Tax-smart investing and making smart asset location decisions are imperative for enhancing one’s wealth over time. The interplay between investment management and tax planning should not be underestimated, and when done correctly, can substantially improve one’s after-tax return. Here at TPW, it is our Fiduciary duty to assess client portfolios for tax optimization to seek the best results possible.

5405 Wisconsin Ave., Suite 330, Chevy Chase, MD 20815

(301) 799-9001

General Disclosure

This Presentation is for informational purposes only and does not constitute an offer to sell or the solicitation of an offer to purchase any security or investment product or services. The content of this Presentation is provided solely for your personal use and shall not be deemed to provide access to any particular transaction or investment opportunity.

TritonPoint Wealth (TPW) does not intend the information in this Presentation to be investment advice, and the information presented in this Presentation should not be relied upon to make an investment decision. Any third-party information contained herein was prepared by sources deemed to be reliable but is not guaranteed.

TPW is a registered investment adviser with the Securities and Exchange Commission providing investment advisory and financial planning services. Any reference to the terms “registered investment adviser” or “registered” does not imply that TPW or any person associated with TritonPoint Wealth has achieved a certain level of skill or training. A copy of TPW’s current written disclosure (ADV 2A Firm Brochure) discussing our advisory services and fees is available for your review upon request. TPW, in addition to providing investment advisory and financial planning services, provides business consulting services. In connection with its business consulting services, TPW does not provide tax or legal advice.

This material is proprietary and may not be reproduced, transferred, modified, or distributed in any form without prior written permission from TPW. TPW reserves the right, at any time and without notice, to amend, or cease publication of the information contained herein. Certain of the information contained herein has been obtained from third-party sources and has not been independently verified. It is made available on an “as is” basis without warranty. Any recommendations, projections, market outlooks, or estimates are based upon certain assumptions and should not be construed as indicative of actual events that will occur.